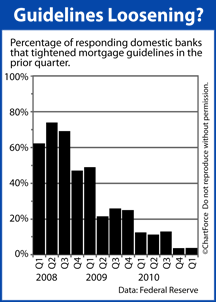

Another quarter, another sign that mortgage lending may be easing nationwide.

Another quarter, another sign that mortgage lending may be easing nationwide.

The Federal Reserve’s quarterly survey of senior loan officers revealed that an overwhelming majority of U.S. banks have stopped tightening mortgage requirements for “prime borrowers”.

A prime borrower is one with a well-documented credit history, high credit scores, and a low debt-to-income ratio.

Of the 53 responding “big banks”, 49 reported that mortgage guidelines were “basically unchanged” last quarter. Of the remaining four banks, two said mortgage guidelines had “eased somewhat”, and the remaining banks said guidelines “tightened somewhat”.

It’s the second straight quarter in which fewer than 5 percent of banks tightened guidelines, and the first quarter in nearly 5 years in which the number of banks that loosened guidelines equaled the number of banks tightening them.

The easing in mortgage lending is a positive development for the housing market; and for buyers in Minneapolis and nationwide. Looser lending standards means that more buyers will be approved for home loans, and that should spur home sales forward across the region.

However, don’t confuse “looser standards” with “irresponsible standards”. It’s much more difficult to get financing today as compared to 2006. Delinquencies and defaults have altered how a bank reviews a loan application.

Today, underwriters are more conservative with respect to household income, total assets and overall credit scores. Even as compared to just 6 months ago:

- Minimum credit score requirements are higher

- Downpayment/equity requirements are larger

- Maximum allowable debt-to-income ratios are lower

If you can get approved, though, your reward is that mortgage rates are especially low. Since early-April, both conforming and FHA mortgage rates have been on a downward trajectory, and pricing is near a 6-month low.

Home affordability is at an all-time high, too.

Looser guidelines and lower rates should help fuel home demand through the summer months. If you’re in the market to buy, your timing appears to be excellent.